Global trade and online business rely heavily on Forex Conversion. It affects everything from e-commerce pricing to international payments and foreign exchange rates. As companies expand into multiple countries, managing accurate currency conversion rates becomes essential to maintain fair pricing and profitability.

In this guide, we’ll explain what Forex Conversion means, how it works, what influences exchange rates, and how automation tools simplify the process for modern online sellers.

What is Forex Conversion – A Brief Overview

Forex Conversion is the process of exchanging one country’s currency for another using an exchange rate. For instance, converting USD to EUR means calculating how many euros equal one dollar at that moment. It plays a critical role in global finance, trading, and cross-border eCommerce, where transactions happen in other currencies.

Every day, millions of forex conversions take place across banks, payment gateways, and online marketplaces. Real-time accuracy ensures fair trade, transparent money flow, and stable pricing across the market.

How Forex Conversion Works

The process begins with two currencies — the base and the quote. The exchange rate shows how much of the quote currency is needed to buy one unit of the base currency. For example, if 1 USD = 0.92 EUR, it means one U.S. dollar can be exchanged for 0.92 euros.

Currency exchange rates fluctuate constantly due to supply, demand, and global conditions. These movements make live exchange rates vital for accurate calculation and smooth transactions in global business.

Importance of Accurate Currency Conversion Rates in Global eCommerce

For cross-border businesses, forex conversion ensures accurate pricing, payments, and profit margins so customers see fair prices in their local currency. Many sellers also use price rounding methods to make converted prices look cleaner and more consistent across markets, enhancing trust and the shopping experience.

Key advantages for businesses include:

- Maintaining consistent and fair pricing across countries

- Preventing losses due to exchange rate differences

- Improving customer trust through transparent pricing

- Simplifying accounting and tax reporting across currencies

Without accurate forex conversion, businesses risk price mismatches, poor customer experience, and lower profit margins.

Key Factors That Influence Currency Exchange Rates

Currency conversion rates differ constantly due to various global factors. Understanding these helps businesses make informed pricing and financial decisions:

Key influences include:

- Inflation and interest rates — Higher inflation or low interest rates weaken a currency’s value.

- Government and central bank policies — Monetary decisions directly impact exchange rates.

- Global demand and trade balance — High exports strengthen a currency, while high imports weaken it.

- Market sentiment and global events — Political stability, conflicts, or major news can shift rates instantly.

Because of these factors, automated systems that fetch live rates are essential for keeping product prices accurate and up-to-date.

The Common Challenges of Manual Forex Conversion

Manual currency conversion can create inconsistencies, especially for online sellers managing several stores across the world. When exchange rates shift frequently, static pricing may quickly become outdated.

Common issues include:

- Inaccurate prices due to delayed rate updates.

- Confusing decimal figures that look unprofessional (e.g., $19.73).

- Increased workload from constant recalculations.

- Risk of reduced profit margins when conversion errors occur.

Such challenges highlight the need for automation — not just for convenience, but for operational accuracy and customer satisfaction.

Best Automation Tools and Currency Converter Solutions for Online Sellers

Today, sellers have dozens of options for Forex Conversion tools, but picking the right one matters most. Most tools, like XE and Google Finance, give exchange rates but stop there. They don’t connect pricing updates to your eCommerce platforms.

QuickSync bridges this gap. It not only converts currencies in real time using live exchange rates, but also updates prices across Shopify, Amazon, Clover, and other platforms, ensuring consistent, accurate pricing for multiple foreign currencies.

- Reduces errors in currency conversion rates

- Automatically applies mid-market rate updates

- Connects currency data directly with inventory and orders

This way, online sellers save time and avoid profit loss caused by fluctuating exchange rates.

How to Turn on Currency Conversion Via QuickSync for Multi-Channel Sellers

QuickSync simplifies global pricing by automating near real-time Forex Conversion with hourly updates. Enabling currency conversion is straightforward. Here we go:

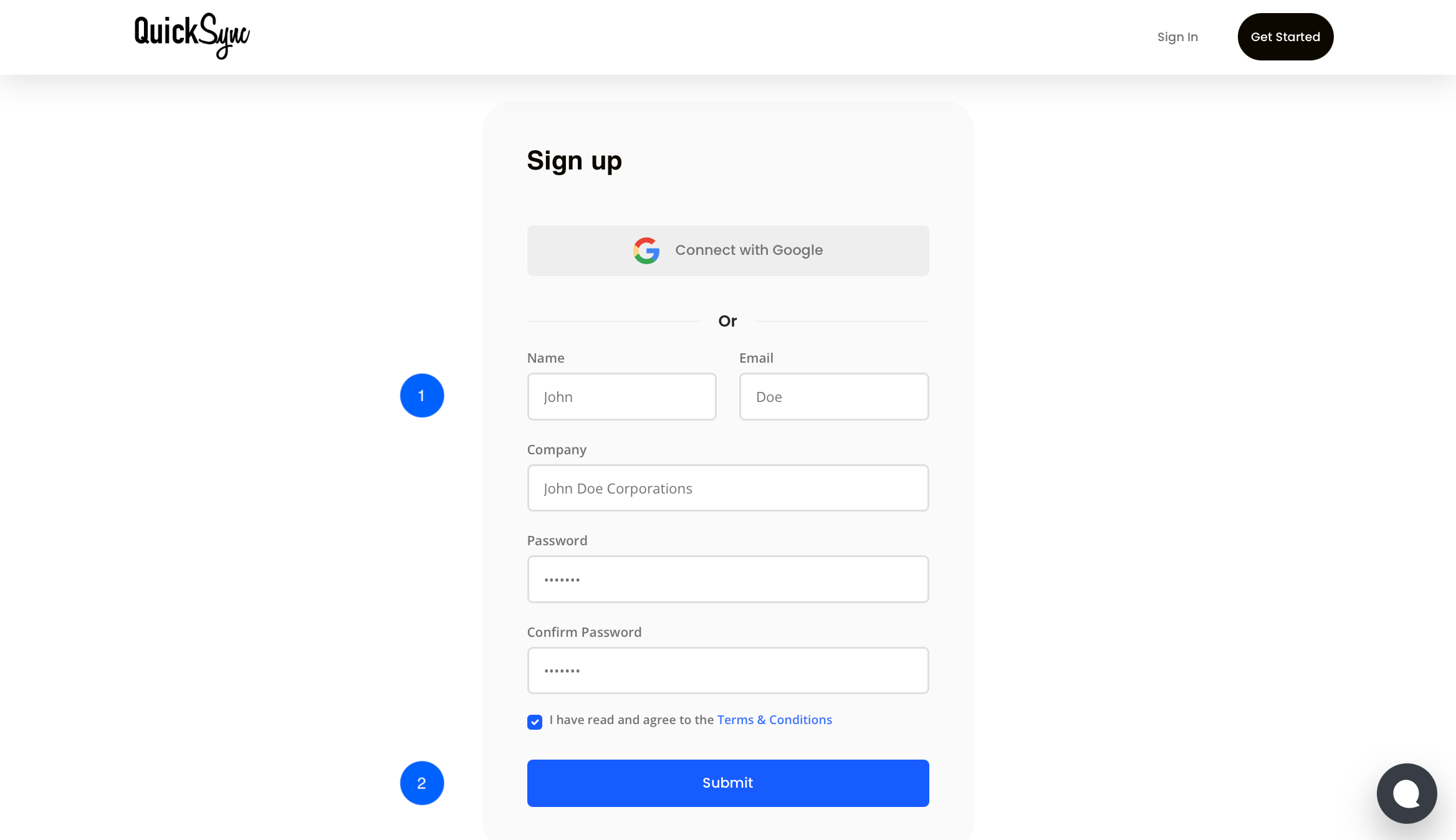

Step 1: Sign In or Sign Up On QuickSync

- Start by logging in to your existing QuickSync.pro account, or create a new one if you don’t already have an account.

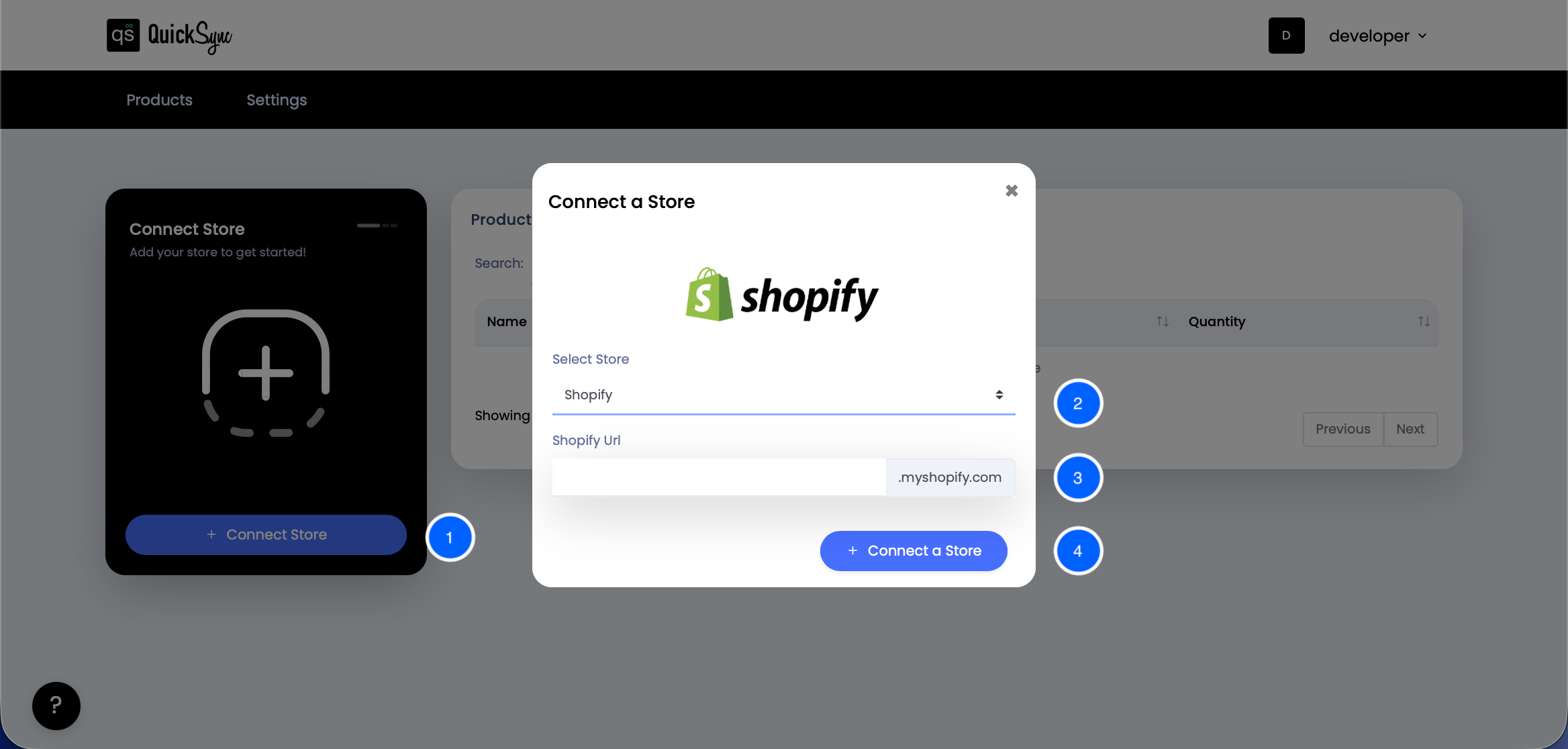

Step 2: Connect Both Stores

- Once logged in, go to the QuickSync Dashboard and click on “Connect Stores.”

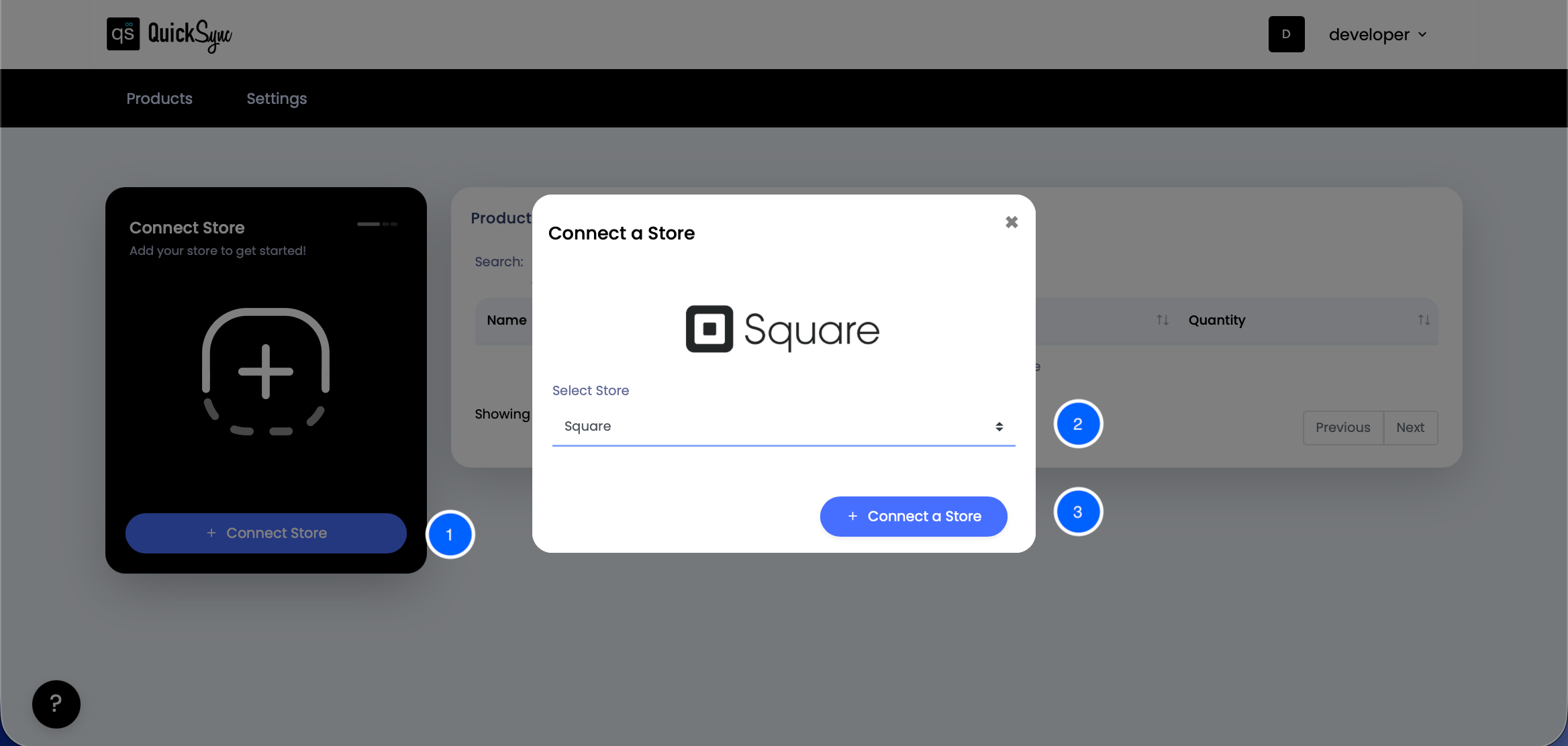

For example, let’s connect Shopify and Square (you can also connect other supported platforms).

- Select Shopify and follow the on-screen steps to connect your store.

- Repeat the same process to connect your Square account.

- Make sure to authorize QuickSync to access your store data for smooth synchronization.

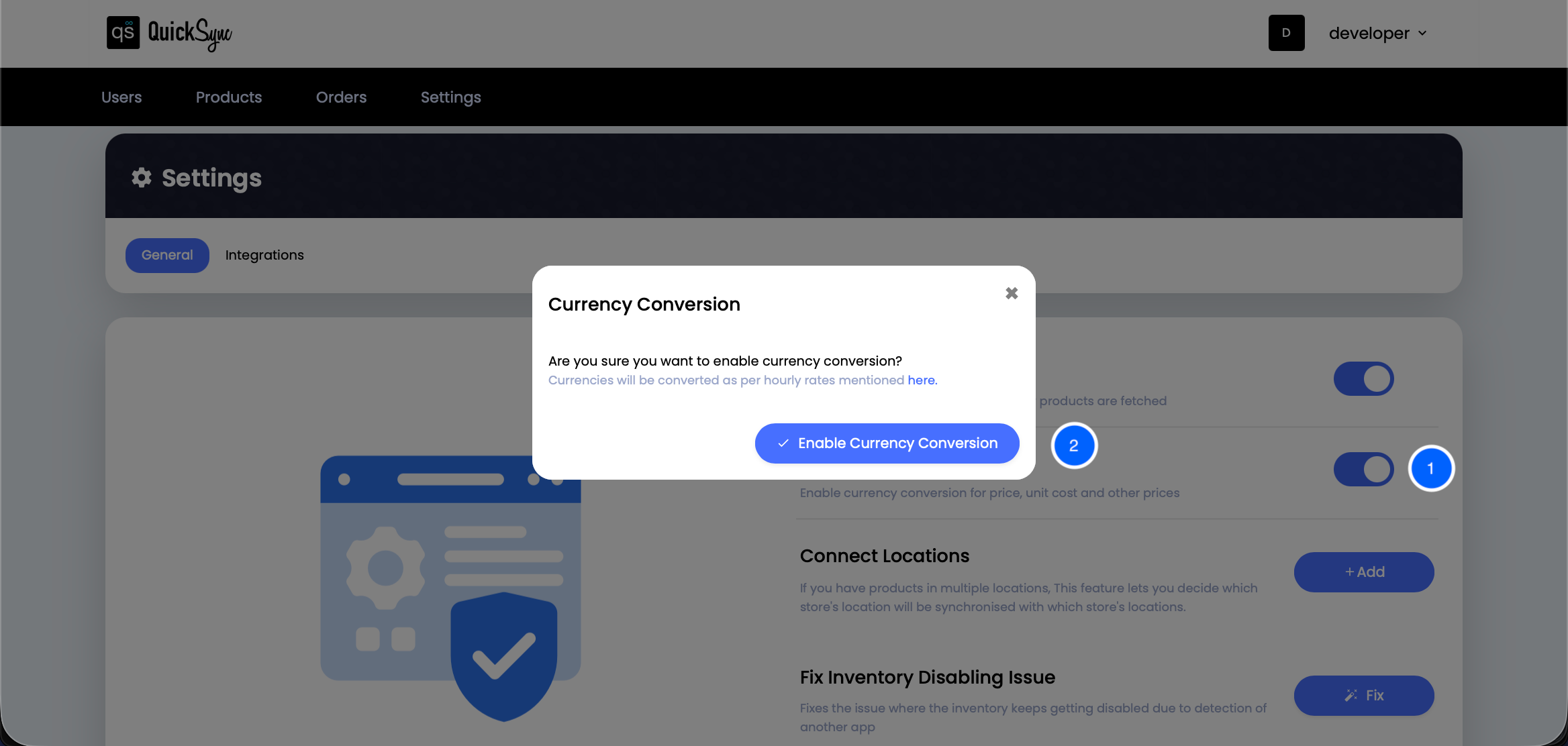

Step 3: Enable Currency Conversion

- After successfully connecting both stores, navigate to the Settings section in your dashboard.

- Locate the Currency Conversion option and toggle it on to enable automatic currency adjustments between your connected stores.

By making this change, QuickSync will automatically adjust all future conversions to the new currency, ensuring accuracy and convenience for your business.

Key Benefits of Automated Forex Conversion With QuickSync

Using QuickSync for Forex Conversion brings several business advantages:

- Always accurate: Prices adjust automatically with hourly exchange rate updates.

- Time-saving automation: Eliminates the need for manual conversions or calculations.

- Customer-friendly pricing: Rounded, clean numbers look more professional.

- System reliability: Continues using the last known rate if live data is temporarily unavailable.

- Complete synchronization: Works seamlessly with product, inventory, and order syncing for total eCommerce consistency.

For example, if a product costs $10 USD and the exchange rate is 1 USD = 1.37 CAD, QuickSync automatically lists it at $13.49 CAD, saving time and ensuring accuracy.

Future of Forex Conversion in Digital Commerce

As online selling becomes more global, reliable, and automated forex conversion is critical. Businesses are increasingly adopting automation tools and smart currency-conversion integrations to enable data-driven pricing.

Platforms like QuickSync integrate currency data and foreign currency pricing updates directly into e-commerce workflows. This enables seamless expansion into international markets while minimizing risks from fluctuations and fees, ensuring consistent profits and improved customer trust.

The Bottom Line

Accurate Forex Conversion is essential for any eCommerce business expanding globally. It ensures fair pricing, protects your profit margins, and builds trust with international customers. Manual conversions are time-consuming and prone to errors, but automation tools like QuickSync make the process seamless.

Get started with QuickSync today and keep your international pricing accurate and consistent across all channels.